Why will IOTA (MIOTA) reach $10 USD Sooner Than You Think – New CDO Advisor

IOTA’s (MIOTA) founder David Sønstebø announced yesterday that Johann Jungwirth, Volkwagen Chief Digital Officer, was joining the IOTA Foundation as an advisor. This is huge not only in terms of expertise for taking the DAG (Directed Acyclic Graph) Tangle to a whole new level, but it’s also huge in terms of a potential game-changing partnership.

Image 1 – David Sønstebø announcement – Source: IOTA’s official subreddit

Volkswagen, in conjunction with Bosch, represent 40% of the patents in automated driving in the world which clearly show us that they are unanimous leaders in the IoT department (Internet-of-Things). This aligns perfectly with IOTA’s (MIOTA) vision which is to become the platform under which we run IoT.

Guess what? Both of them are partnering with IOTA as we speak which only leads to the conclusion that IOTA will be a Colossus in the crypto world. This project has the potential to become the internet 3.0 and it is currently competing with projects that have in no way as much applicabilities as IOTA does.

So, what is setting IOTA back?

Some concerns about IOTA caused a rattle in the community which led to a lot of people cashing out on their investments consequently. This led IOTA’s (MIOTA) price downwards before any dip took place, which was observable through their slide down the charts in coinmarketcap to #11, it was once in #5.

What were these concerns?

Mainly the hashing function Curl that was designed by the IOTA Foundation which received criticism from the MIT (Massachusetts Institute of Technology) saying that their function produced collisions where two different inputs generated the same output. These concerns were answered by the Foundation just a few weeks later by changing their function to Kerl which was based on similar principles but didn’t involve collisions. The name was given as a homage to the function “Curl” that preceded it.

Also, IOTA’s tangle currently depends on a supporter that keeps the network safe whilst it’s still in its infancy years. The network works but it still hasn’t been proven to work without it which brings a lot of FUD (Fear, Uncertainty and Doubt) to their project.

When you add this to the last problems that IOTA’s hot wallet had when launched, which were later taken care of, you see how honest investors could be driven away as a result.

Despite these being honest and real concerns, it also shows us that IOTA addresses their own issues with frontality and plans to work on them, which is something that cannot be said about every crypto project.

One thing is certain, big companies such as Volkswagen and Bosch see potential in it, so why wouldn’t we?

Market Analysis

The newly batch that just joined the crypto community has been in shock after seeing their investments go downwards for almost two weeks in a row now but remember that 50% losses in a dip are somewhat fine since we’ve had bigger dips before, some of which even got a 70% drop.

This really puts in perspective what we should expect from now on, every single year previous to this one, after the holidays, the market hit a bump which then led to another period of stable growth. When there’s smooth sailing in the crypto market again we’ll start to see those ridiculous increases over short periods of time since everyone recognizes the market tendencies.

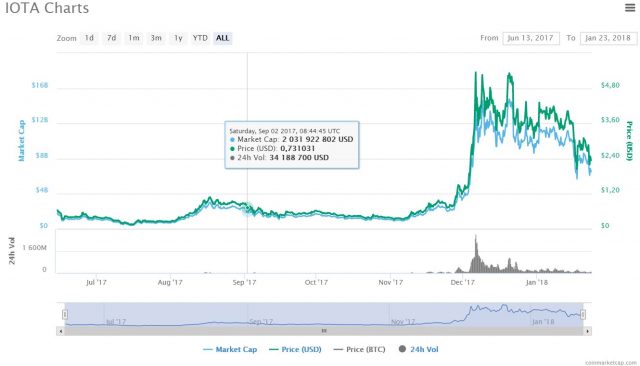

Image 2 – IOTA (MIOTA) Charts – Source: coinmarketcap.com

Beware, this month might be the last time you see IOTA (MIOTA) in the single digit department. Less than a year ago the community had its eyes set on the $1 USD milestone and it came quicker than everyone expected going from $0.15 USD on 16th of July to $1.08 USD just one month later. My prediction is that IOTA will reach $10 USD by as early as late February, or the beginning of March.