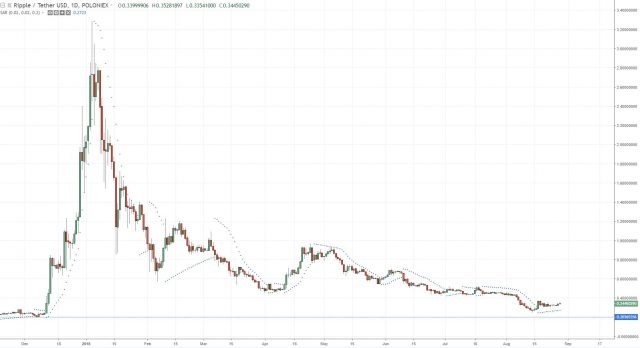

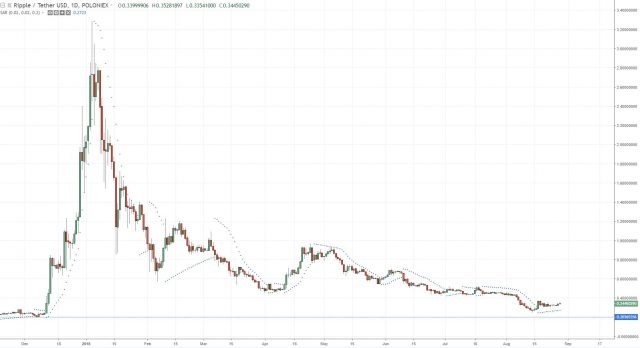

XPR/USD Technical Analysis – 28th August 2018 – Possible Predications

Ripple has cemented itself as number three in the coinmarketcap table. It continues to create partnerships with financial service companies which can only be a good thing for the price.

However, like the whole cryptocurrency market is has continued to create new lows since its high at the beginning of January. Will this market find a bottom or will we see this slide continue? We take a technical look at XRP/USD and try to identify a direction for this market.

Please note that all analysis is an opinion based on technical features and shouldn’t be used as investment advice.

XRP/USD is still in a down trend from the high of $3.28 from January 4th 2018. This is confirmed by the market creating lower lows and lower highs. I would consider the high of July 18th as the latest swing high, which saw the market trade at $0.52. For this market to break the down trend, we need to see that high breached and for it not to break the low created on the 14th of August of $0.24.

If you are looking to buy Ripple, then this is a waiting game, waiting for the market to show you that it is ready to turn.

The market previously found really strong support at $0.20, so I would be more inclined to wait and see if it can hold on that level. Should we see a rejection on that level then it might begin to see the market turn. Buying at that level is always a risk because you are still buying whilst the market is going down.

For a less risky strategy I would want the market to show me that it is beginning its uptrend. The issue with this is that you may lose a lot of the move up.

Deciding where to get in then depends on your trading philosophy, are you happy to get in early with increased risk of losing but for larger returns or are you more cautious and want to wait for the market to show you that it has turned.

My preference is to wait for the rejection on the big level of $0.20 and then to enter a small amount, you can then look to average into the position.

XRP/USD Stop Loss Placement

I would always recommend using a stop loss when trading because it allows you to manage your risk. My stop loss order would be under the $0.20 level, perhaps between $0.10 and $0.15, bearing in mind that these markets are renowned for their volatility, meaning that you could get spiked out.

XRP/USD Long Targets

Identifying a target is again very difficult in cryptocurrency markets, namely because they are so new and it is all relatively new ground for them. The most obvious target would be the resistance level of $0.52 and then $0.93.

Longer term, my targets based on Fibonacci would be $2.61 (which also aligns with an area of resistance) and then $4.11. The all time high is also an area to look at ($3.27) however given the way most cryptocurrencies act at their all time highs, I wouldn’t be surprised to see the market cruise through that.

A time frame is considerably more difficult to predict, but I would imagine that it will move with fundamental news, so any major partnerships could see this market begin it’s rally. For longer term predictions from other experts see this ripple article.

Disclaimer: As previously highlighted, this is simply an opinion and should not be considered investment advice. It is at the user own risk they trade volatile markets.