Another 500 Million Ripple (XRP) Stashed Away in Escrow

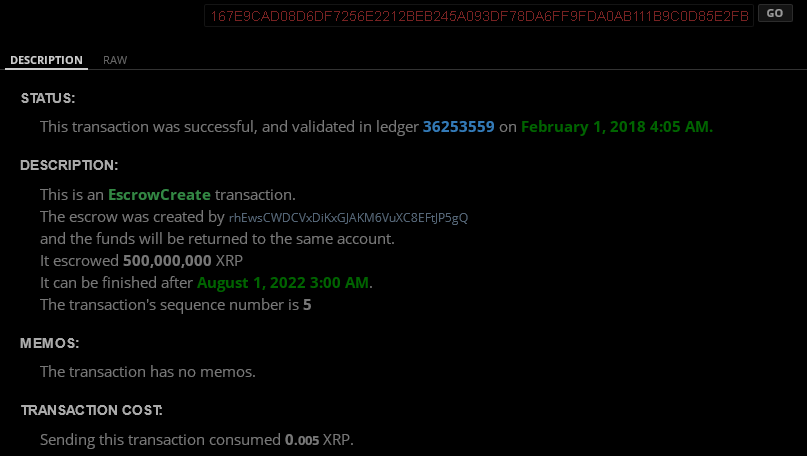

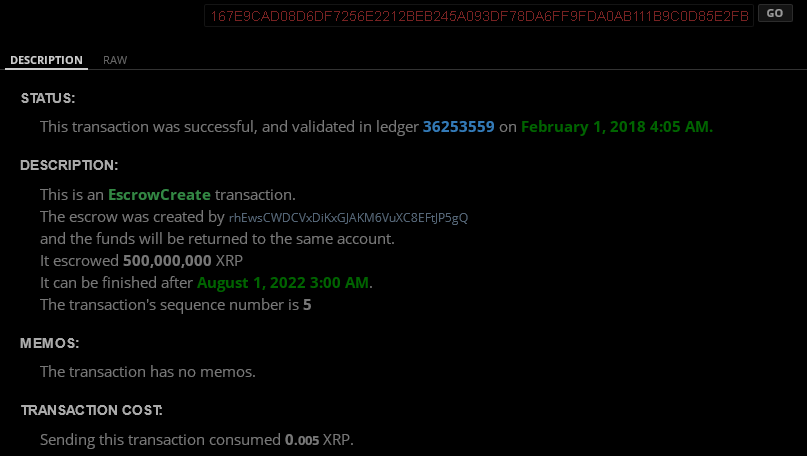

[Photo: 500 Million XRP Escrow transaction Source:xrpcharts.ripple.com]

News reaching my Telegram news-feed indicate that another 500 Million Ripple (XRP) tokens have been locked up in Escrow. The transaction took place on February 1st, 2018 at 4:05am. The locked up coins will next be available on August 1st, 2022, 3am. This is a period of approximately four and a half years. Another 400 Million was later put in Escrow, bringing the total to 900 XRP locked up.

The first Escrow lock up was by Ripple when they locked up over 55 Billion XRP. The move was aimed at guranteeing supply of the coin. Each month since the lock up, 1 billion tokens will be unlocked for Ripple’s use, and any unused tokens will be placed back into escrow. This in turn controls the supply and avoids situations where a single individual can dump or hoard all the coins at a go.

According to an earlier Ripple article, Escrow allows XRP Ledger and ILP to communicate to secure XRP for an allotted amount of time or until certain conditions are met. This can be used to hold funds until a service is completed, or until a moment in time such as a birthday. The benefits to Escrow are two-fold. Firstly, it completes this task securely without having to trust intermediaries. Secondly, no single institution is in charge of holding the funds. Banks traditionally have done this through the use of a vault, but this is the first readily available feature of its kind that facilitates this for digital assets.

So who could have access to over 900 Million XRP coins?

Using the current value of Ripple at around $0.805, (02/02/2018, 11;03am UTC – 3) this means that the current value of the coins is $724.5 Million.

The only plausible owner of such an amount, has to be either Bruce Wayne :-), a massive hedge fund, a big bank or a very wealthy individual who does not want to trade his Ripple (XRP) during this volatile period in the Crypto-Verse.

Another simple explanation could be simply the Ripple Organization itself using the feature earlier described of unlocking 1 Billion coins for their use per month, and then locking up what was not used.

The current value of Ripple ($0.805) was last seen on December 20th, 2017. The coin would later skyrocket to $3.83 on January 4th due to rumors of a pending addition of the coin on Coinbase. The rumor had suggested that XRP would be added on January 8th. However, representatives at Coinbase came out and announced that it had no such plans. This in turn sent the coin in a downward spiral that it has yet to recover from as I shall explain.

Coincidentally, the market has been suffering major correction brought about by a bombardment of bad news after bad news on the Cryto-Verse. First it was the South Korean government threatening regulation. Then there was the case of a $530 Million heist at Coincheck. This heist prompted the Japanese government to issue a declaration of inspecting all Crypto-exchanges in its jurisdiction to make sure they were secure. There was also the subpoena by the US regulators on Bitfinex due to the connection with Tether. And now, there were rumors that India had banned Crypto-trading. This last rumor has since been debunked.

It is such bad news that can lead an individual with 900 Million coins to decide to lock them up and literally forget about them for 4.5 years. Such a move would avoid the heartache associated with constantly checking the market that smaller traders, like myself, fall victim to. In 4.5 years, the price of Ripple (XRP) could have reached the $10 mark making such a lock up in escrow, to be worth $9 Billion.

Either way, the move is a very wise move for an individual or organization. It guarantees that the owner does not touch the coins in any way as the market looks bearish to the point of some traders wanting to scream.

The future of the market is uncertain, but I have heard one trader on a Telegram group warn other members by telling them, ‘Hold on to your trousers, it might get a bit rough in the next few weeks!’

Are your trousers held on tight?!

Follow us on Telegram.