Coinbase just enabled Bitcoin Cash (BCH) to Euro (EUR) trading – What to expect

Coinbase has been in the spotlight ever since they enabled trading for Bitcoin Cash (BCH) without any previous warnings or heads-up and then disabled that trading because of suspicions of insider trading for a while. But this market was only available when paired with USD which means that neither with Bitcoin (BTC) nor EUR markets were available.

These markets represent huge flows of money and surely will bring another climb in price of Bitcoin Cash (BCH). Will this be permanent? Probably not, because Bitcoin Cash has already a stained reputation within the crypto community. After the video of the interview made with Roger Ver, one of the leading supporters and investors of Bitcoin Cash, the community was shocked because he clearly was in it for the profit and had business model planned for himself based on the promotion of this coin.

The link for this interview can be found through this link.

Yet, one must not forget that when you’re making an investment a “pump and dump” is something risky, but sometimes for traders this can bring an enormous upside, with the variety of metrics available for trading such as the RSI, Oscillator and Ichimoku Cloud, we are able to predict market trends.

You don’t need these metrics for a good trade, since the source of news you choose sometimes gives wiser advice than any formula so this addition by Coinbase of Bictoin Cash (BCH) is clearly an opportunity for the ones who get it early.

So, What can we expect?

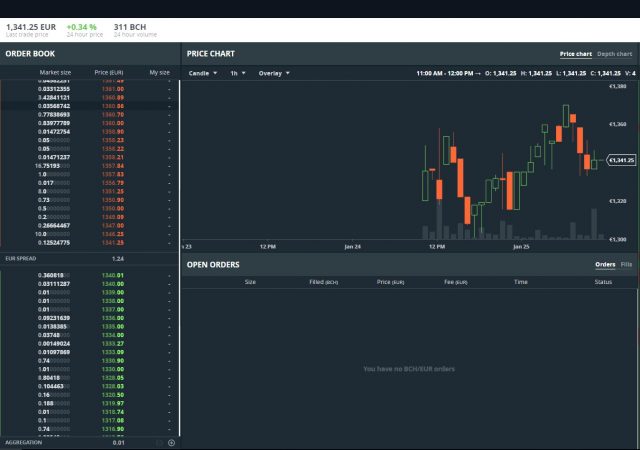

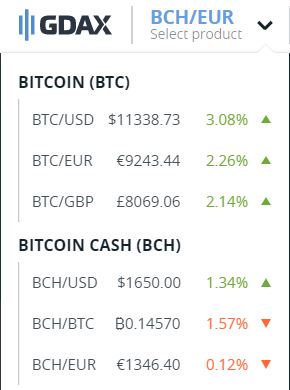

Currently Bitcoin Cash can be purchased through GDAX, the Coinbase exchange, and is being traded at €1346.40 EUR or $1650.00 USD. It once was at $400 USD which means that Bitcoin Cash is one of the most affected by the January crash that we are all witnessing.

Image 1 – Bitcoin Cash (BCH) trading pairs – Source: gdax.com

I personally think that Bitcoin Cash (BCH) does not have many upsides and the coin sitting at #4 in coinmarketcap.com shows us that maybe it is over evaluated with a total market cap of 28 billion USD. Now it sure seems that this Bitcoin-wannabe, that is sitting next to giants like Ripple (XRP) and Stellar (XLM), does not bring not even remotely the same possibilities.

Which in my opinion will lead to people realizing that this is just another failed Bitcoin (BTC) fork that tried to piggyback of Bitcoin’s success and will eventually fade.

Still we cannot forget that for trading sometimes the relevance of the coin is somewhat small, not that I’m saying we should have no filter but a project such as Bitcoin Cash (BCH) is a project that was added on Coinbase which means that we will probably continue to see it in the top charts, at least for a couple of years.

This means that it is a valid choice for those who seek trading with no fees which is the GDAX major upside. They’re able to do this because of supposed mining pools which they control and try to confirm their own transactions, probably they have other ways for it to reduce costs too.

Market Analysis

The market is still a little “depressed” but I personally think we already went through rock-bottom, and now there is only one way to go, to the expected trillion-dollar mark. This mark was once a lot closer but now sets on the horizon. We’ll probably wait less time than expected since in previous years the market behavior observed was the same and by February we were already back to the all-time highs of the previous holidays.

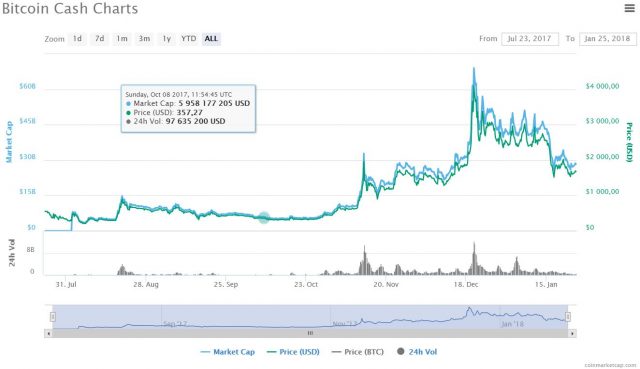

You can see Bitcoin Cash’s behavior in the past year below: